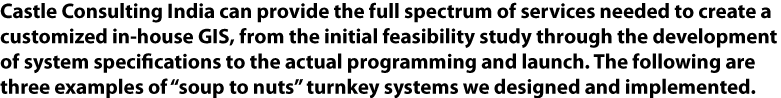

MetLife Realty Group (subsequently acquired by State Street Research

and now a part of BlackRock) provides real estate investment advisor services to

union pension funds and other institutional investors. As such, it offers a comprehensive

range of real estate functions including research, appraisal, property acquisition,

property management, portfolio-level asset management, and so on. MRG wanted to

have all its various divisions integrated under one corporate wide information to

system to ensure that all MRG personnel were accessing the same data, and that the

data would be the most current and reliable information available on any given market,

property, transaction, etc. Recognizing the “location, location, location” nature

of real estate, MetLife wanted its internal information system to be GIS-driven,

and accordingly retaining Castle Consulting. To the right is a diagram appearing

in published articles on the resulting system. GIS software from ESRI provided the

gateway to extensive Oracle data bases, which in turn linked to a constellation

of internal and third-party data sources, spreadsheets and other analytic tools,

ongoing MRG administrative systems, and so on. In short, GIS technology fulfilled

its full potential for efficiently and cost-effectively integrating, analyzing,

and presenting everything of importance to MRG’s operations.

MetLife Realty Group (subsequently acquired by State Street Research

and now a part of BlackRock) provides real estate investment advisor services to

union pension funds and other institutional investors. As such, it offers a comprehensive

range of real estate functions including research, appraisal, property acquisition,

property management, portfolio-level asset management, and so on. MRG wanted to

have all its various divisions integrated under one corporate wide information to

system to ensure that all MRG personnel were accessing the same data, and that the

data would be the most current and reliable information available on any given market,

property, transaction, etc. Recognizing the “location, location, location” nature

of real estate, MetLife wanted its internal information system to be GIS-driven,

and accordingly retaining Castle Consulting. To the right is a diagram appearing

in published articles on the resulting system. GIS software from ESRI provided the

gateway to extensive Oracle data bases, which in turn linked to a constellation

of internal and third-party data sources, spreadsheets and other analytic tools,

ongoing MRG administrative systems, and so on. In short, GIS technology fulfilled

its full potential for efficiently and cost-effectively integrating, analyzing,

and presenting everything of importance to MRG’s operations.

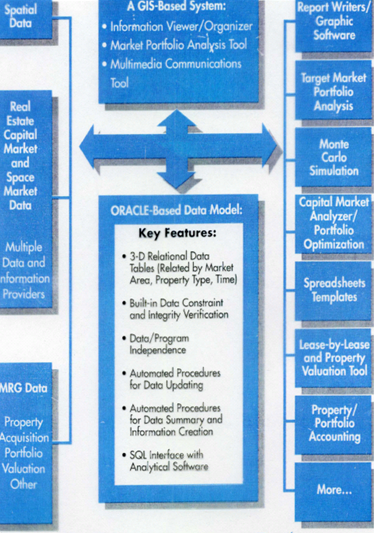

The

Urban Land Institute is the largest professional association of real

estate developers in the world, with some 40,000 members and 50 Councils (local

chapters) worldwide. ULI is known for its innovations in the industry. In that tradition,

the San Francisco council decided to create an Internet portal to development-related

GIS data bases in the nine county Bay Area. Castle Consulting was retained to educate

council members on GIS technology and the full range of portal options available,

and ultimately to design and implement the portal. Now available to the public at

http://urbanmap.org,

the portal organizes, ranks, and directly links to hundreds of GIS maps in all 110

Bay Area jurisdictions. The links are organized both by location (e.g., cities in

Marin County, including zoning, assessor parcels, and general plan maps) and by

critical themes (environmental restrictions, commercial properties for sale, economic

development zones, and so on). Castle Consulting is now exploring how best to the

portal in the jurisdictictions of all the other ULI councils.

The

Urban Land Institute is the largest professional association of real

estate developers in the world, with some 40,000 members and 50 Councils (local

chapters) worldwide. ULI is known for its innovations in the industry. In that tradition,

the San Francisco council decided to create an Internet portal to development-related

GIS data bases in the nine county Bay Area. Castle Consulting was retained to educate

council members on GIS technology and the full range of portal options available,

and ultimately to design and implement the portal. Now available to the public at

http://urbanmap.org,

the portal organizes, ranks, and directly links to hundreds of GIS maps in all 110

Bay Area jurisdictions. The links are organized both by location (e.g., cities in

Marin County, including zoning, assessor parcels, and general plan maps) and by

critical themes (environmental restrictions, commercial properties for sale, economic

development zones, and so on). Castle Consulting is now exploring how best to the

portal in the jurisdictictions of all the other ULI councils.

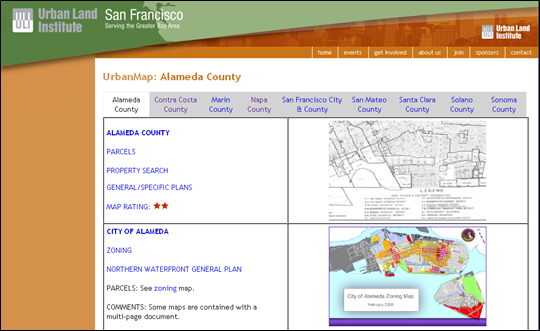

REIT

Value is the name given by Castle Consulting to an in-house, proprietary

system developed for in-house use in investing in Real Estate Investment Trusts

(REITs) and other publicly traded real estate securities. The methodology was designed

to beat the market by exploiting two sources of information arbitrage: Calculating

a Net Asset Value (NAV) for every property in each publicly traded REITs, and then

identifying major discrepancies between the Castle Consulting calculated aggregate

NAV for any given REIT and the market’s consensus NAV for that REIT. (2) Developing

a real estate investment attractiveness score by property type for all the major

cities in the U.S. (as Castle Consulting has done for many clients over the years),

then mapping the locations of all the REITs’ properties onto those markets, and

finally indexing the degree to which each REIT held properties in improving or deteriorating

real estate markets. Castle Consulting was then able to plot all REITs on a chart

with the two information arbitrage factors arrayed against each other, as conceptually

shown to the right. The resulting investments were profitable, with an average annualized

ROI exceeding 20%.

REIT

Value is the name given by Castle Consulting to an in-house, proprietary

system developed for in-house use in investing in Real Estate Investment Trusts

(REITs) and other publicly traded real estate securities. The methodology was designed

to beat the market by exploiting two sources of information arbitrage: Calculating

a Net Asset Value (NAV) for every property in each publicly traded REITs, and then

identifying major discrepancies between the Castle Consulting calculated aggregate

NAV for any given REIT and the market’s consensus NAV for that REIT. (2) Developing

a real estate investment attractiveness score by property type for all the major

cities in the U.S. (as Castle Consulting has done for many clients over the years),

then mapping the locations of all the REITs’ properties onto those markets, and

finally indexing the degree to which each REIT held properties in improving or deteriorating

real estate markets. Castle Consulting was then able to plot all REITs on a chart

with the two information arbitrage factors arrayed against each other, as conceptually

shown to the right. The resulting investments were profitable, with an average annualized

ROI exceeding 20%.